Il Car Sales Tax Private Party . Web the illinois department of revenue (dor) dec. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. In addition to taxes, car purchases in illinois. Web the taxes can be different in the case of a vehicle being purchased by a private party. 1, 2021 published the private party vehicle use tax chart for 2022,. Web the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party.

from www.templateroller.com

1, 2021 published the private party vehicle use tax chart for 2022,. Web the taxes can be different in the case of a vehicle being purchased by a private party. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. Web the illinois department of revenue (dor) dec. Web the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. In addition to taxes, car purchases in illinois. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on.

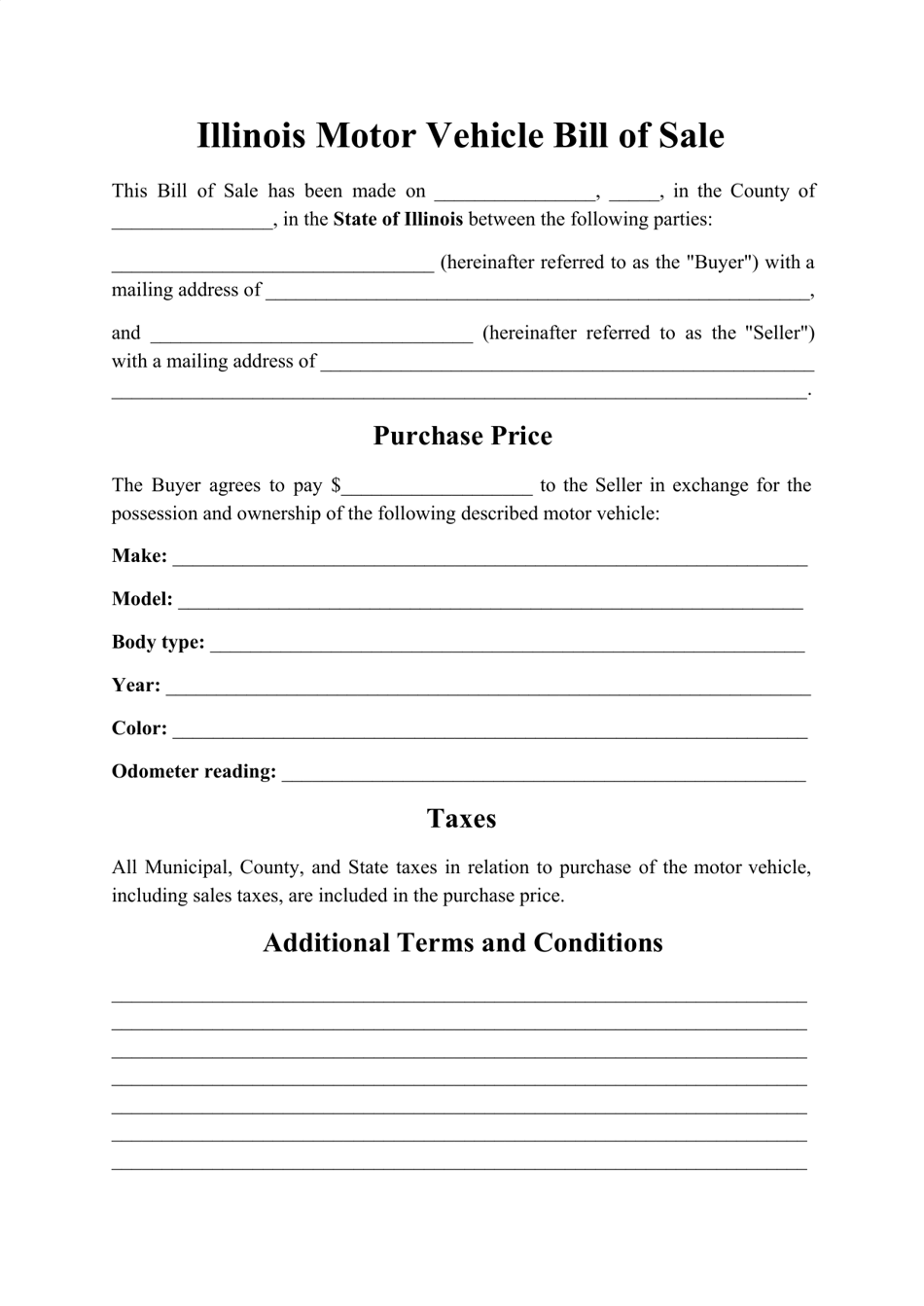

Illinois Motor Vehicle Bill of Sale Form Fill Out, Sign Online and Download PDF Templateroller

Il Car Sales Tax Private Party 1, 2021 published the private party vehicle use tax chart for 2022,. 1, 2021 published the private party vehicle use tax chart for 2022,. Web the illinois department of revenue (dor) dec. Web the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. In addition to taxes, car purchases in illinois. Web the taxes can be different in the case of a vehicle being purchased by a private party.

From www.carsalerental.com

Arizona Sales Tax Used Car Private Party Car Sale and Rentals Il Car Sales Tax Private Party Web the taxes can be different in the case of a vehicle being purchased by a private party. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. Web illinois private party vehicle use tax is based on the purchase price (or fair. Il Car Sales Tax Private Party.

From privateauto.com

How Much are Used Car Sales Taxes in Minnesota? Il Car Sales Tax Private Party Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. Web illinois private party vehicle use tax is. Il Car Sales Tax Private Party.

From www.carsalerental.com

When Do I Pay Sales Tax On A New Car Car Sale and Rentals Il Car Sales Tax Private Party Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. In addition to taxes, car purchases in illinois. Web the taxes can be different in the case of a vehicle being purchased by a private party. 1, 2021 published the private party vehicle. Il Car Sales Tax Private Party.

From www.rocketlawyer.com

Do I Need To Pay Taxes on Private Sales Transactions? Rocket Lawyer Il Car Sales Tax Private Party 1, 2021 published the private party vehicle use tax chart for 2022,. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. Web the taxes can be different in the case of a vehicle being purchased by a private party. Web illinois private. Il Car Sales Tax Private Party.

From natashaglover.z13.web.core.windows.net

Illinois Vehicle Sales Tax Chart Il Car Sales Tax Private Party Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. In addition to taxes, car purchases in illinois. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,.. Il Car Sales Tax Private Party.

From exohxanqx.blob.core.windows.net

Illinois Tax On Car Sale at Jacqualine Barney blog Il Car Sales Tax Private Party 1, 2021 published the private party vehicle use tax chart for 2022,. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions. Il Car Sales Tax Private Party.

From www.templateroller.com

Form RUT50X Fill Out, Sign Online and Download Fillable PDF, Illinois Templateroller Il Car Sales Tax Private Party In addition to taxes, car purchases in illinois. 1, 2021 published the private party vehicle use tax chart for 2022,. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web for example, if you buy a used car from a private party for $10,000,. Il Car Sales Tax Private Party.

From www.templateroller.com

Illinois Motor Vehicle Bill of Sale Form Fill Out, Sign Online and Download PDF Templateroller Il Car Sales Tax Private Party In addition to taxes, car purchases in illinois. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. 1, 2021 published the private party vehicle use tax chart for 2022,. Web the illinois department of revenue (dor) dec. Web the tax is imposed on motor. Il Car Sales Tax Private Party.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals Il Car Sales Tax Private Party Web the taxes can be different in the case of a vehicle being purchased by a private party. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web illinois private party vehicle use tax is based on the purchase price (or fair market value). Il Car Sales Tax Private Party.

From exozhhwmx.blob.core.windows.net

Used Car Illinois Sales Tax at Terry Shuler blog Il Car Sales Tax Private Party Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. Web the illinois department of revenue (dor) dec.. Il Car Sales Tax Private Party.

From eforms.com

Free Illinois Motor Vehicle Bill of Sale Form Word PDF eForms Il Car Sales Tax Private Party 1, 2021 published the private party vehicle use tax chart for 2022,. Web the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web for. Il Car Sales Tax Private Party.

From www.carsalerental.com

Private Party Car Sales Tax California Car Sale and Rentals Il Car Sales Tax Private Party In addition to taxes, car purchases in illinois. Web the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web illinois private party vehicle use. Il Car Sales Tax Private Party.

From cezrodos.blob.core.windows.net

Car Sales Tax Illinois Cook County at Christy Calvin blog Il Car Sales Tax Private Party Web the illinois department of revenue (dor) dec. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. Web the taxes can be different in the case of a vehicle being purchased by a private party. Web the tax is imposed on motor. Il Car Sales Tax Private Party.

From formdownload.net

Download Free Used Car Bill of Sale Form Form Download Il Car Sales Tax Private Party Web the illinois department of revenue (dor) dec. Web for example, if you buy a used car from a private party for $10,000, you’ll pay $625 in sales tax plus local (city and county) tax,. 1, 2021 published the private party vehicle use tax chart for 2022,. Web the tax is imposed on motor vehicles purchased (or acquired by gift. Il Car Sales Tax Private Party.

From dxowerojc.blob.core.windows.net

Auto Sales Tax Norridge Il at John Boysen blog Il Car Sales Tax Private Party Web the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. 1, 2021 published the private party vehicle use tax chart for 2022,. Web the taxes can be different in the case of a vehicle being purchased by a private party. In addition to taxes, car purchases in illinois. Web. Il Car Sales Tax Private Party.

From exozhhwmx.blob.core.windows.net

Used Car Illinois Sales Tax at Terry Shuler blog Il Car Sales Tax Private Party In addition to taxes, car purchases in illinois. Web the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web the taxes can be different. Il Car Sales Tax Private Party.

From www.carsalerental.com

Used Car Sales Tax Private Party Car Sale and Rentals Il Car Sales Tax Private Party Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. In addition to taxes, car purchases in illinois. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web the. Il Car Sales Tax Private Party.

From www.carsalerental.com

Illinois Car Bill Of Sale Template Car Sale and Rentals Il Car Sales Tax Private Party Web the tax is imposed on motor vehicles purchased (or acquired by gift or transfer) from another individual or private party. In addition to taxes, car purchases in illinois. Web illinois private party vehicle use tax is based on the purchase price (or fair market value) of the motor vehicle, with exceptions noted on. Web the illinois department of revenue. Il Car Sales Tax Private Party.